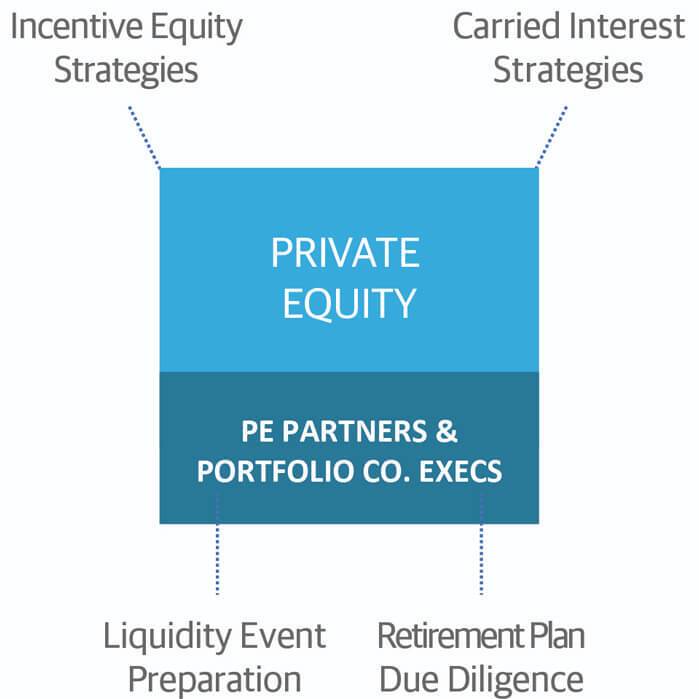

SPECIALIZED PRIVATE EQUITY PLANNING

Private Equity Partners and Portfolio Company Executives are familiar with the risk/reward profile for their investment decisions. The wealth creation opportunity is significant, but involves complex assets and requires time to mature. Managing cash flow and income distribution as well as maximizing the value of personal portfolios takes specialized planning and expertise. As a member of the Northwestern Mutual Private Client Group, our firm brings this specialization, along with the exclusive access, deep expertise and expanded resources of Northwestern Mutual.

PRIVATE EQUITY PARTNERS

Personal financial success requires an advisor that understands your industry. Our depth of experience and network of experts equips you to address critical planning areas and take advantage of unique opportunities.

PORTFOLIO COMPANY EXECUTIVES

Your incentive equity will have a significant impact on your wealth-building plan. We bring an in-depth knowledge of private equity and understand how the flow of capital in a private equity transaction impacts your personal wealth.

PRIVATE EQUITY PROFESSIONALS

THREE CORE NEEDS OF PE PROFESSIONALS

Investment Management: Balancing “outside” wealth with “inside” wealth, that is, managing your personal investments to compliment carried interest and co-investments.

Risk Planning: Protecting your family if something should happen to you before your private equity carried interest is realized.

Legacy Planning: Transitioning your wealth to the next generation and supporting the charitable causes most important to you.

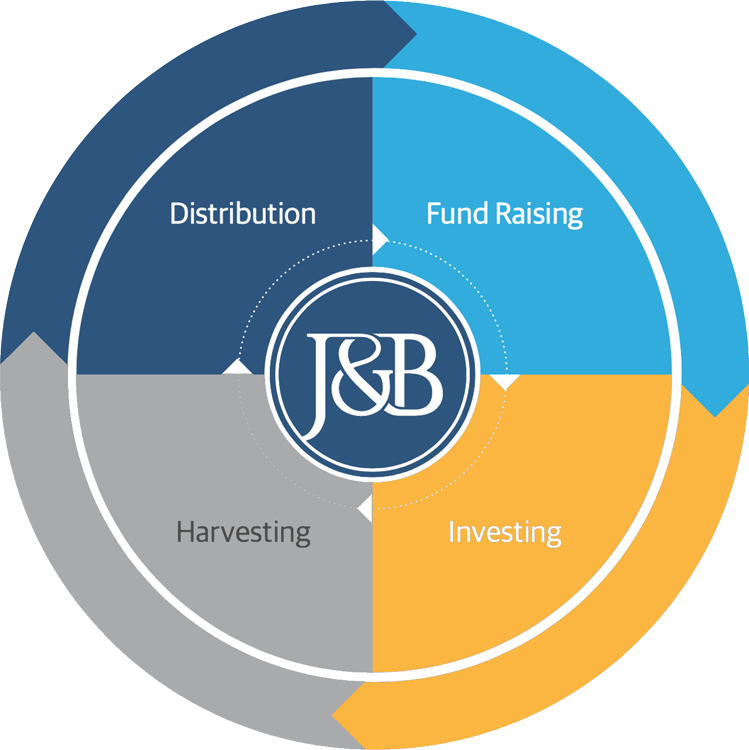

WE ARE PROACTIVE IN THE PRIVATE EQUITY CYCLE

Fund Raising: Prepare for capital calls and co-investment liquidity needs.

Investing: Optimize outside investment portfolios based on committed capital.

Harvesting: Plan for liquidity events as firm exits platform companies.

Distribution: Allocate carried interest and co-investment proceeds to support the next fund and for additions to investment portfolio.

We allocate your investments based on your dynamic net worth picture and build your portfolio around your private equity concentration.

PORTFOLIO COMPANY EXECUTIVES

INCENTIVE EQUITY PLANNING

As advisors to PE portfolio company executives, we understand and apply planning principles within the context of the private equity business model. Incentive equity will significantly impact your wealth-building plan and, with declining average holding periods for private equity, planning horizons are accelerated.

- While potentially a “once in a lifetime” opportunity...too often... there is failure to prepare.

- Life changes immediately when the private equity firm launches the sale process.

- You will NOT have time to devote to personal planning for your family.

- You cannot control the timing of the sale.

ONLY YOU can control the timing of your personal planning and preparation.

LIQUIDITY EVENT PREPARATION

Without intentional planning for a Liquidity Event, you may fail to take advantage of wealth preservation strategies and be unprepared for the tax consequences.

While the private equity firm’s M&A advisors will guide the leadership team through the sales process, Johnson and Brannen is here to help you navigate your intentional personal planning for preparation of the liquidity event.