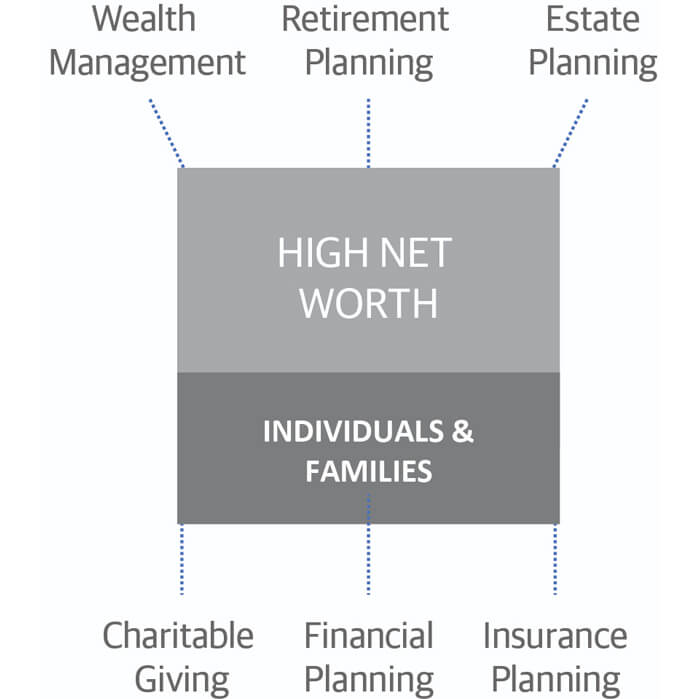

A FINANCIAL PARTNERSHIP THAT GOES BEYOND YOUR PORTFOLIO

Navigating the unique complexities that come with significant wealth requires a higher level of skill and a deeper partnership that goes beyond your assets.

As a leading member of Northwestern Mutual’s exclusive Private Client Group, we approach private wealth management differently—offering a broader perspective by connecting all aspects of your finances with what you want out of life.

Our comprehensive approach allows us to see the blind spots others miss, seamlessly align your other financial relationships, and give you the edge you and your family need to enjoy your wealth.

A BROADER PERSPECTIVE FOR BETTER WEALTH PLANNING

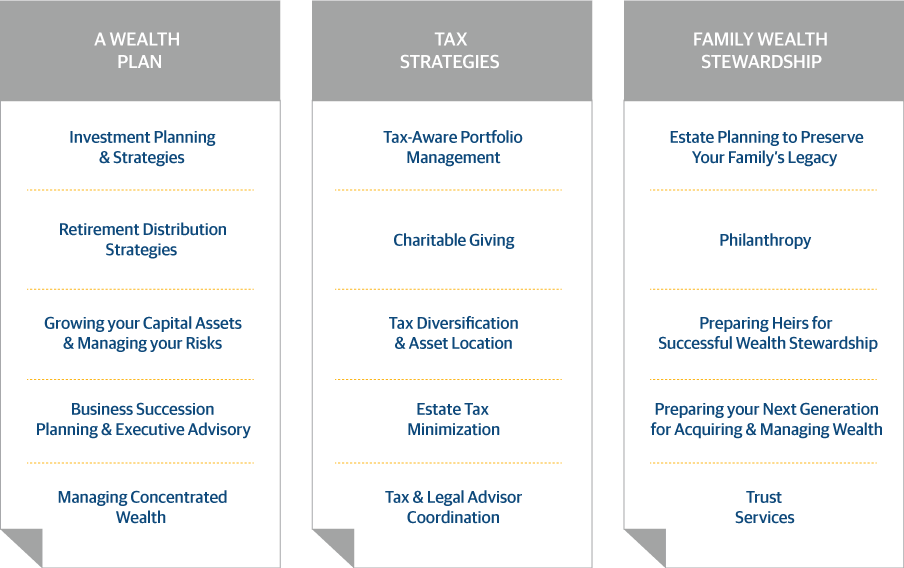

We approach private wealth management differently.

- Building a comprehensive plan that combines advanced investment and risk management strategies, allowing you to invest even more confidently.

- Establishing a disciplined approach that sheds light on how strategic tax planning can reduce the impact of taxes to you and your legacy.

- Building multigenerational plans that help you protect and preserve what you’ve worked so hard for.

TAX STRATEGIES

Navigating the complexities of tax exposure that come with significant wealth requires specialized experience and expertise. A poorly structured portfolio or a tax-inefficient wealth plan can become the single biggest drag on wealth building and estate preservation.

We bring the depth and breadth to help our clients become well-positioned from a tax planning perspective by utilizing proactive strategies that work well in an ever-changing legislative environment.

- Tax-Aware Portfolio Management – Identifying solutions for tax-efficient investing and borrowing

Once we understand your situation, we tailor solutions that can help you reach your goals to preserve more wealth, for example, by combining tax-efficient investing with trust planning and other strategies. For business owners and executives, we integrate personal and business tax planning to help you achieve better outcomes. Creative financing strategies including customized mortgages and securities based lending can help enhance flexibility and reduce tax costs. - Charitable Giving - Giving more strategically to maximize the impact of your donations

We help you give more strategically, for example, by using donor-advised funds or family foundations to have more flexibility and maximize the value and tax-advantaged impact of your donations. Our team continuously monitors the tax environment to keep you current with events that may signal the need to adjust your plan. - Tax Diversification & Asset Location – Allocating investments to enhance after-tax returns

Location is key when it comes to the type of account (IE, Roth IRA, 401(k) or taxable account) you use to hold various investments. Carefully selecting the best account for a particular type of investment can make a big difference in the amount of investment returns you keep after taxes. Investments are subject to varying tax treatments and understanding how to implement an asset allocation across different account types can lower your annual tax bill and add to your bottom line. Further, having a tax diversification plan in place to hedge against future changes in tax rates, can reduce the risk of paying unnecessary taxes and provide increased optionality during retirement. - Estate Tax Minimization – Mitigating estate taxes and administrative costs

Gift and estate taxes can limit your ability to transfer your wealth to the right people, at the right time, and in the right way. With intentional planning, we can help you integrate strategies in your estate plan that reduce the taxes on your estate. - Tax & Legal Advisor Coordination – Coordinating and collaborating with your advisors

We work closely with you and the rest of your advisor team to build a sound framework for wealth building and estate planning. We can help you evaluate your team and incorporate new members as your needs change.

FAMILY WEALTH STEWARDSHIP

Every family has unique family wealth stewardship needs — entrusting the next generation to be responsible stewards and creating a thorough succession plan for your assets.

By applying a multi-generational approach, our team makes it simpler for you and your family to manage estate plans and philanthropic aspirations that maximize wealth preservation and your potential for impact.

- Estate Planning to Preserve your Family’s Legacy – Your wealth conveyance plan is fundamental to your overall financial plan

We help you coordinate your estate planning with your other advisors, including attorneys, accountants, and other fiduciaries, to set up trusts, minimize estate taxes and administrative costs, and protect your estate from mismanagement. - Philanthropy – Bringing your philanthropic vision to life

Giving back can be among life’s most fulfilling legacy. Done well, your philanthropy creates positive change in the lives of others. We offer a range of philanthropic services and advice. Starting with your goals or vision, we help you articulate the impact you want to have, the amount you want to give, and then identify the structure that’s right for you. - Prepare Heirs for Successful Wealth Stewardship – Establishing philanthropic family values

This structure may involve members of your family so that you can have an impact now and, through family stewardship, create a legacy that could last generations. Establishing strong philanthropic family values is critical so that inherited wealth entrusts not enables heirs to carry forth the family legacy. We can help you select the charitable goals and best practices for family stewardship that creates excitement and enthusiasm – so you can make an impact now and create a legacy that could last generations. - Prepare your Next Generation for Acquiring and Managing Wealth – Aligning your vision and goals and those of your family

A proactive approach to multi-generational wealth planning can help reduce intra-family conflicts and work to preserve and enhance the relationships among your heirs. Whether you are passing down a business, investments, or property, we have experience advising families on both the emotional and technical elements of wealth succession planning. - Trust Services – Preserving and protecting your assets

You may want to provide direction for your assets long after you’re gone. We can help you navigate the best way to set up a trust based on your goals for your money and your family, coordinating with your attorney and other advisors.