OCTOBER 27, 2020

My lifetime consumption of Seinfeld far exceeds a normal lifetime’s worth of sitcom watching. In fact, it has become one of the lenses through which I process interpersonal communication, interpret life’s strange happenings and maintain a semblance of amusement to the world around me. Not a day passes where I don’t find myself experiencing a “Seinfeld moment.” 2020 has provided many such moments, but for our purposes, I have found “The Wig Master” episode to offer wonderous social and investment commentary.

In this episode, Jerry seeks to return a recently purchased jacket solely to deny Craig, the salesman who sold him the jacket and subsequently mocked him, a commission. When asked for the reason he is returning the jacket, Jerry responds, “For spite.” The proud manager smugly informs Jerry that he cannot return an item based purely on spite.

While Jerry Seinfeld may not have been able to return luxury clothes for spite in 1996, it seems the modern consumer of 2020 can return just about anything based purely on spite. This includes, but is not limited to: stocks, mortgage interest, lease agreements, promissory notes from the SBA, public health policies AND presidents. In fact, with just minimal observation powers, one could easily deduce that wide swaths of humans (currently residing in the United States) are capable of springing irrational thought into action based entirely on spite. To expound upon the examples eluded to earlier:

- Grocery shoppers wearing a mask with either a sense of pride as a signal of care and virtue OR with a glasses-fogging huff of disgruntlement.

- Policymakers supporting or opposing COVID policies as well as business and school closures and openings based upon the originating party.

- Investors who unwisely seek to ‘put their money where their vote is’ by engaging in (to repurpose a politically-charged, 2020 buzz-word) … ‘binary’ investing: an ‘in-or-out’, ‘all-or-nothing’ proposition.

- Note: For those looking to cash or money market accounts (earning 0.22% nationally) to create a sense of long-term financial security, you will only need to wait 316 years to double your money at current rates. On the bright side, if the Fed is successful in achieving its 2% inflation target, you just need to stick around for another 39 years for your cash’s purchasing power to be cut in half.

- And finally, as we disappointedly watched in the first debate, presidential candidates who seemed more interested in spiting the other candidate than engaging in a spirited discussion on the issues.

I’m sure if you’d asked the fly why it landed on Mike Pence’s head, he would’ve buzzed, “for spite,” as well.

WARREN BUFFET: “IF YOU MIX POLITICS WITH YOUR INVESTMENT DECISIONS, YOU’RE MAKING A BIG MISTAKE.”

Warren Buffett has not risen to the upper reaches of investment success by being intimidated by the occupying person or policies of the White House. In fact, there is little basis for a hypothesis that the stock market’s performance and the president are correlated. Some 2000s era examples include:

- 2000: George Bush, a mainstream Republican and free market conservative, was elected in hopes of unleashing the U.S. economy by lowering taxes and helping people achieve the “American Dream”— aka home ownership. THEN… tech bubble recession, 9/11 and a global financial crisis. The result: The S&P 500 returned -0.52% in Bush’s first term and his second term yielded a worse -5.19%.

- 2009: As far as most republicans were concerned, the progressive Democrat, Barack Obama, was going to destroy modern medicine and the global preeminence of American healthcare and put our national security at risk. The result: The S&P 500 increased at a blistering 12.87% annual return following election day through the end of his tenure in office with healthcare outperforming the market at 14.22% during that same period (Source: Morningstar return data from 11-05-2008 through 01-20-2017).

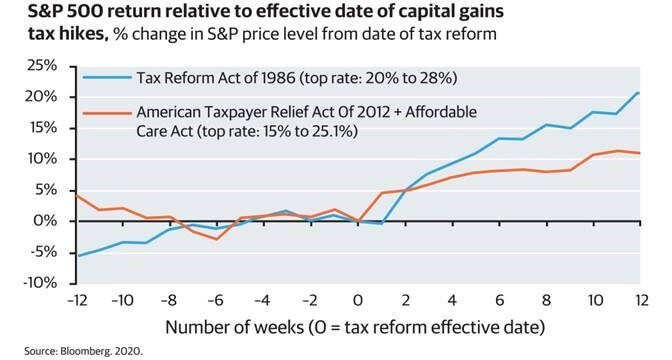

- 2012: American Taxpayer Relief Act and Affordable Care Act became law resulting in tax increases. Result: The increase in maximum capital gains tax rate from 15% to 25.1% had almost no effect on market values.

- 2017: The days of the “Trump trade” began when his tweets could move stock prices by large percentage points in a single day. It was widely thought that industrials would far outpace the broad market given his campaign promise to renegotiate trade deals which would bolster US-based manufacturing. As a result, industrials exploded after the election. The results? Industrials have delivered an 8.21% annualized return since his inauguration underperforming the S&P 500’s 14.12% annual return (Source: Morningstar as of October 22, 2020).

Bottom line: Over the long term, policies are important and do impact the market. However, business cycles are much more impactful to returns than the controlling party. Taxes, tariffs and regulations may cause short term friction, and there is always a cost to adapting to new market and regulatory dynamics. However, as long as companies still have the right earn a profit, it will be innovation, ingenuity, shrewd management and strong leadership that continue to drive these profits.

MARKETS BEAT ELECTIONS AT THE GAME OF FORTUNE TELLING

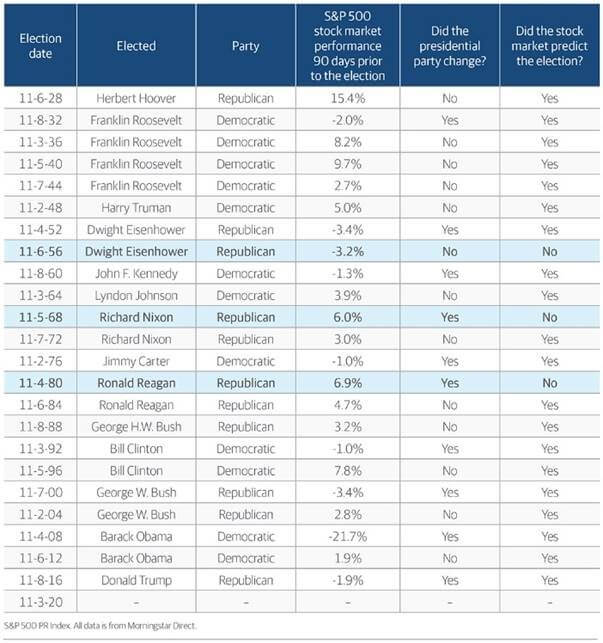

While elections have been a poor predictor of stock market performance, the stock market has predicted the outcome of 20 out of the past 23 elections and every election since 1984.

On only 3 occasions since 1928 has the S&P 500’s performance in the 90 days leading up to the election been unsuccessful in forecasting the outcome of the election. In the other 20 elections, or 87% of the time, the incumbent party has won the election if the market was up and lost the election if the market was down. Since August 3rd, the market sleeplessly rests … cue Friday the 13th theme music…. up 2.9%.

That said, the market seems to be pricing in a greater chance of a Democratic Sweep. Current market valuations would indicate the following:

- Relative outperformance of FAAMG stocks (FB, AAPL, AMZN, MSFT, GOOG) has been flat for the past 3 months which could be indicative of greater anti-trust enforcement (IE, DOJ v Google) that would likely occur in a Biden administration

- Recovery of relative performance of companies with high exposure to the trade war with China and high levels of international sales

ELECTION NIGHT OWLS WILL BE HOOTING FOR WEEKS WITH LITTLE SLEEP TO SHOW FOR IT

If President Trump has proven anything over the past 4 years, it’s that you can’t count him out in any circumstance. While the polls would forecast a landslide victory for Biden, Trump votes could be under-polled significantly based on a worsening of 2016’s polling inaccuracies and the compounding negative social and cultural connotations many Trump voters would just soon avoid by misleading pollsters.

Staying up to the wee morning hours on November 3rd will likely not be rewarded by knowing the winner of the election. Hint: the market already knows this and has likely already priced in whatever overblown concern for market disruption that a disputed election will cause. Those comparing sectors that fared well immediately following 2000’s disputed election have little to no assurance these sectors will do well this time as most analysts are already anticipating a delayed result.

While there could be street protests, there is a well-defined process that will force a result within a few weeks of the election. Without going into the details of this process, rest assured… if you aren’t a fan of the electoral college, you will be most perturbed with the culmination of an electoral college that doesn’t produce a 270-vote majority. In this scenario, the house elects the president with each state’s representatives voting internally to decide who their state will cast its ONE vote for (irrespective of its population).

EARLY VOTING

Early voting began two weeks ago in Athens. When I asked the gentlemen at the front of the line how long he had been waiting, he responded, “3 hours.” I have a feeling that if I’d asked him why he waited so long he would’ve responded, “for spite.” So, when it comes to managing your investments during the election, I urge investors to not factor in ‘spite’ in their investment decision making. You’ll have another go at whoever wins in 4 years. If we get too off tilt in one direction, the remaining few independents will likely bring us back.

The opinions expressed are those of Johnson & Brannen Advisor Group as of the date sent and are subject to change. There is no guarantee that the forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any investment or security. Past performance is not a guarantee of future results